How to Right-Size Your Middle-Mile Network for Rural Broadband Growth

Have you ever purchased something where you didn’t plan and anticipate your future needs correctly and you ended up needing to replace it with something larger, something that can scale with greater capacity to meet your needs? Something that leaves you with a nagging feeling, that if you had just planned better from the start it would have saved you a lot of time, money and aggravation?

For example, my son recently graduated from college and the first car he went and bought was a 2-seater red convertible with a trunk that can barely hold a suitcase. Now he wants to go mountain biking and kayaking on the weekend and realized he will need to upgrade to a truck and will reluctantly have to sell the sports car.

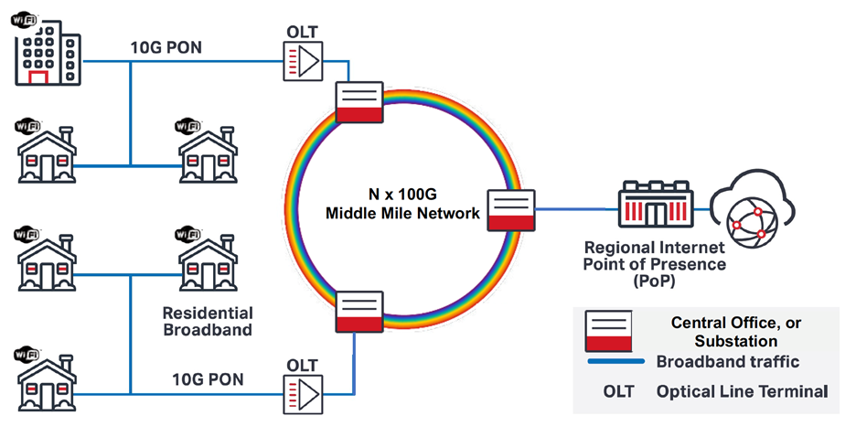

Well, it is not hard to fall into the same trap when it comes to planning for a Middle-Mile Network for Rural Broadband. Middle-mile networks are typically fiber rings that aggregate the traffic from service provider central offices or utility substations that connect residential customers in rural areas as shown in Figure 1. Whether it’s utility co-ops, regional service providers or municipalities, all need to plan for future broadband demand on these middle-mile networks. As we have seen during the pandemic, people living in rural areas have welcomed the opportunity to work from home; they shop, consume entertainment, and access advanced education services and critical healthcare data online. The COVID-19 pandemic has only accelerated these trends: elevating high-speed reliable broadband from a “nice to have” service to an essential one, just like water or electricity.

Figure 1: Middle-Mile Network Architecture

Now how should regional service providers and utilities (let’s say operators for short) plan for their Middle-Mile? Well, 100G is considered the new bandwidth currency for the Middle-Mile. But is 100G sufficient for this digital future? Some access equipment vendors whose platforms are limited to 100GE Middle-Mile backhaul capacity would argue that it’s right sized for future growth. But operators need to look at the factors driving broadband capacity both today and in the near future to come up with an accurate model to plan for their Middle-Mile networks.

Here are some of the key factors that operators need to consider in a model to plan for scalability in their Middle-Mile networks:

1. Broadband Customer Penetration

When operators launch a new broadband service into a community, they won’t typically acquire all their potential market in the first year. Broadband penetration will grow based on how many homes are passed by fiber or fixed wireless and this will likely occur in phases as new broadband customers sign-up for service. Since rural broadband is typically being rolled up in unserved communities with no existing broadband offering in service and pent-up demand, penetration rates will likely rise faster than in urban areas. One utility co-op in Alabama recently provided me an example of pent-up demand for broadband; where an installer putting in a new broadband service for a customer was upgrading from 3 Mbps copper DSL to a 900 Mbps fiber service; and the customer was literally in tears once she saw the difference in performance!

2. Application-Specific Bandwidth Drivers

During the pandemic, consumers hunkered down to consume video content at home versus visiting their local movie theater and they started doing video calls, whether personal or for work. As a result, the biggest driver for traffic growth has been streaming video content. Today, Netflix, Disney+, Amazon Prime, and YouTube are the leading online video services. Most of the streaming content is in high definition at 720p, 1080i and 1080p resolutions. The greatest growth however is at 4K resolutions. When we looked at this in 2014, 4K was still in its infancy both in the penetration of 4K TVs sets and the amount of 4K content. Yet today in 2021, the penetration rate of 4K TVs is 44% in the US (Source: Statista) and with this users can stream all the content from Disney+ and Amazon Prime in 4K resolution, as well as a significant amount of Netflix’s content (if they subscribe to their top tier package). Analysts predict that the percentage of content streamed in 4K will continue to increase substantially as 4K becomes the de facto standard for streaming.

Newer services, still in their infancy today, promise to take the demand even further. That is the case of 8K-resolution video and cloud gaming. Cloud gaming services such as Google Stadia, Microsoft xCloud and Playstation Now offer users the ability to stream their games from the cloud with no need of a gaming console. The amount of bandwidth required for cloud gaming is effectively the same as streaming 4K content, requiring better network performance.

3. The number of devices consuming broadband in the home

While a single 4K TV can consume 30 Mbps of a broadband connection, what matters for Middle-Mile sizing is how many devices are consuming broadband simultaneously in the peak hour, typically the evenings from 8pm to 11pm. An advanced household could have a single 4K TV, an HD TV, a dongle or gaming console consuming cloud gaming (equivalent to a 4K TV) and some mobile devices on WiFi such as iPads and smartphones. A Middle-Mile bandwidth sizing model must estimate the average number of such devices to assess the effective average broadband demand per household.

4. How hot does an operator want to run their Middle-Mile network?

When an operator engineers their network, they need to maintain a certain buffer capacity to allow for special events where a higher than typical number of their subscribers will be streaming video at the same time. This could be sporting events like the World Series, Super Bowl, or the Olympics. This will drive demand beyond typical usage, so operators need to engineer in excess capacity for these situations. How much of a buffer is up to each individual operator– it is directly linked with the user experience they are committed to deliver - typically operators engineer aggregation capacity so that average demand results in no more than 75% utilization, to accommodate the additional strain of these occasional events.

So, what is the impact of these factors combined on the sizing of a Middle-Mile network? Well, we commissioned analyst firm ACG Research to create a bandwidth sizing model for Middle-Mile networks for rural broadband to help us model it. You can download the white paper on their findings here.

ACG created a base model using a network with 20,000 households which is considered the average for rural America. They used a rural penetration rate growing from 25% to 60% over 5 years (#1 above), a network engineered to 75% of capacity (#4 above); leaving 25% as a buffer. Assumptions for items two and three are included in the white paper.

The white paper uses an approach called the Average Household Data Rate. This is an average data rate in the peak hour per household that the operator can use to multiply against the number of broadband households served to estimate the required average aggregate bandwidth needed in the Middle-Mile network.

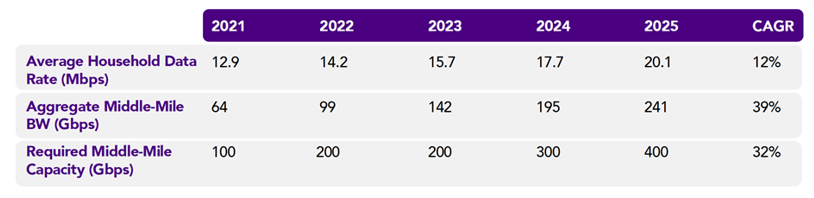

Figure 2: Middle-Mile Network Capacity Requirements

The result shown in Figure 2 provides both the Aggregate Middle-Mile capacity (Gbps) and Required Middle-Mile capacity (Gbps) for the Middle-Mile network.

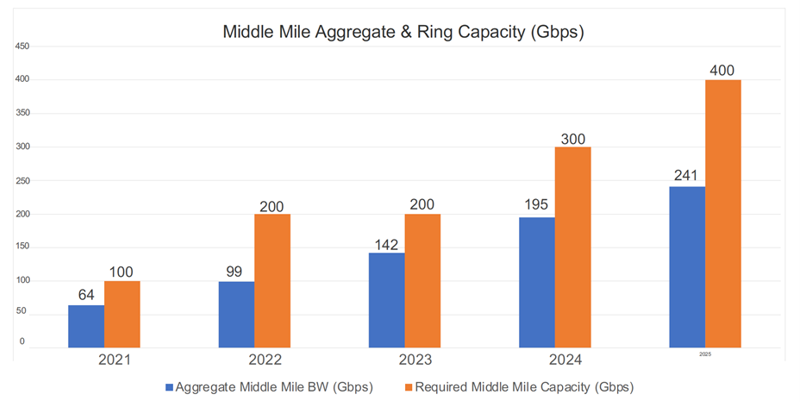

Figure 3: Middle-Mile Network Capacity Requirements

The bottom line shown in Figure 3 is that 100 Gbps is the bare minimum to keep up with bandwidth demand even for a rural network of 20,000 households. This projection shows that up to a 400 Gbps Middle-Mile ring will be required at the end of year 5. Bottom line, this proves that operators need to plan for a dedicated Middle-Mile network that can scale to support N x 100 Gbps of capacity in just a couple of years.

Ciena’s Middle-Mile Network solution

With Ciena’s Routing and Switching platforms, which deliver best-in-class Middle-Mile universal aggregation, Ciena enables operators to build a scalable N x 100 Gb/s Middle-Mile backbone for internet broadband traffic in a converged solution. Ciena platforms can scale to enable operators to add broadband customers and increase bandwidth utilization per household. Ciena’s N x 100 Gb/s Middle-Mile network means that broadband customers can have faith in the performance of their subscribed services and know that they have the bandwidth to simultaneously satisfy all their streaming, work-from-home, remote education, smart home, and remote healthcare needs—well into the future.

So back to our original premise of planning a Middle-Mile network to anticipate future demand. Like my son who thought it would be cool to get a convertible, had he anticipated his future needs to be able to carry his mountain bike and kayak, he would have opted for the truck or SUV – and saved himself the hassle and cost of having to upgrade his vehicle so quickly.

We want to ensure that regional service providers and utilities have the required tools to plan their Middle-Mile networks to anticipate their future growth as well and consider the best-in-class platforms for this use-case.

If you want to learn more about how Ciena helps power Middle-Mile networks, please check out this white paper, "Multi-service Substation WAN Backbone: Ready for Broadband," as well as this case study for a utility co-op in Alabama that used Ciena’s 5171 for their Middle-Mile network.