Why service providers sit at the intersection of edge cloud drivers and demand

Cloud services are big business. Total enterprise spending on cloud services was $500B in 2022 and is expected to grow to $900B by 2026, representing a CAGR of 16%1. It's a significant shift in the way that IT is deployed by enterprises and changes the way that compute and storage by hyperscalers, and connectivity by communication service providers (CSP), must be delivered in this emerging cloud ecosystem.

More broadly, demand for cloud continues to rise as the Internet of Things (IoT), artificial intelligence, 5G, and other technologies become more commonplace within everyday life. Let’s examine some of these trends driving cloud growth.

Machine Learning / Artificial Intelligence

Machine learning and Artificial Intelligence (AI) are used to analyze reams of data to identify business insights. Examples of this include using AI to analyze credit card transactions to identify fraud, or for telcos to reduce the amount of robocalls on their networks. These applications require petabytes of data to be uploaded to the cloud on a timely basis and require infallible and super-fast connectivity to properly function.

A great example of how the telecom industry is leveraging AI to stop robocalls can be found in this case study from WANDisco. The company helped a global telecommunications operator leverage AI to identify robocalls in seconds, where it previously took days. The operator migrated over 22 PB in less than one year. Data teams went from blocking nearly 138 million robocalls per month to blocking over 1 billion robocalls per month through the use of cloud-scale analytics.

Internet of Things (IoT)

Billions of internet-enabled devices with sensors are forecast to be deployed over the coming decade. Examples of these include robots in smart factories, drones, and weather sensors on power lines. According to IDC’s 2022 Worldwide Global DataSphere Forecast, the fastest source of data creation by type will be the IoT category at 49% CAGR from 2021 to 2026. One automotive parts supplier in Europe had added sensors to all their products which they ship to the major auto manufacturers. They collect and migrate this data to the cloud, providing valuable insights to their customers. This data business is expected to become a major source of revenue in the future.

Edge computing

The billions of IoT devices described above will produce petabytes of data that will need analysis close to where the data is created to uncover insights and take timely actions on that data. As a result, the cloud resources (edge computing) to analyze that data must be located close to where the data is created and consumed, at the edge of the network. This fundamentally changes the way data flows between end devices and cloud resources, as the cloud will be more distributed and network traffic will be more “meshy” as a result.

5G vRAN Telco Cloud

A new approach to deploying 5G technology is virtualization of the Radio Access Network (RAN) software or vRAN. The RAN software function, which is traditionally deployed in dedicated hardware at cell sites, can instead be virtualized in the cloud. However, if the vRAN is located in the centralized cloud, the latency to the 5G cell sites could be too high to function properly. As such, the cloud-based vRAN must be located at the edge physically closer to 5G cell sites. This is another good example of the need for edge computing.

Hyperscalers are leveraging their cloud expertise to offer this Telco Cloud service to mobile network service providers by moving their cloud resources closer to the edge to address this emerging marketing opportunity.

Multi-Cloud

While enterprise customers are increasing their share of IT spend in the cloud, they recognize the risk of “putting all their eggs in the same cloud basket." As a result, enterprises desire choice between cloud providers and the ability to move their cloud spending across those providers. A great example of this is the recent Pentagon cloud contract, which was originally intended to be awarded to single cloud provider. However, in December 2022, the Pentagon followed a multi-cloud approach by awarding the $9 billion contract to four cloud vendors: Amazon, Google, Microsoft, and Oracle.

Service providers sit at the intersection of edge cloud drivers and demand

As these technologies continue to grow and place significant pressure on connectivity, infrastructure must be in place to manage that increase in demand.

Enterprise customers are looking for a cloud on-ramp network model that can scale to 100/400Gb/s and higher with a consumption-based billing model that aligns with how cloud services are billed today.

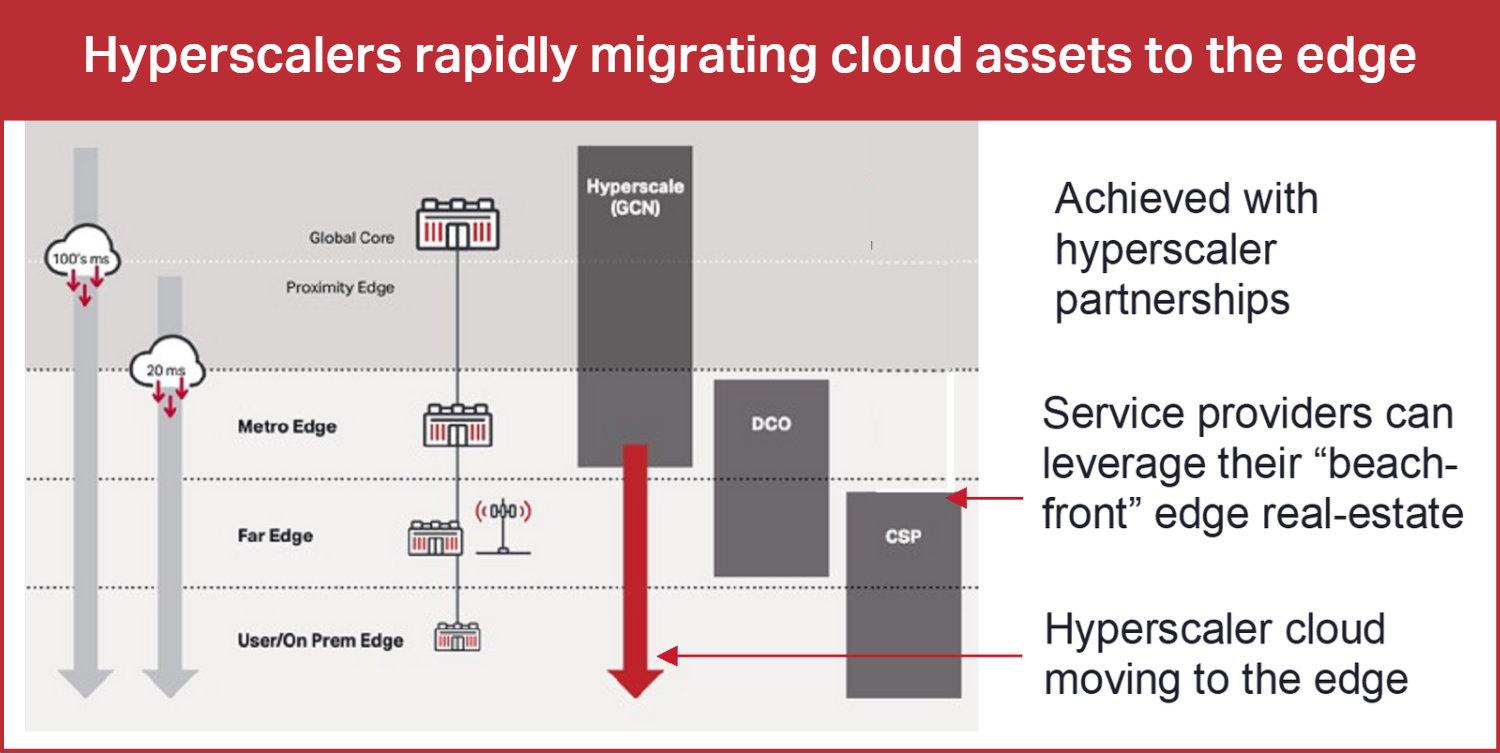

Hyperscalers are facing the challenge of meeting customer demand for cloud services closer to the edge. It is forecast that 50% of hyperscaler cloud capex will occur at the edge in 2025 according to TBR.

Figure 1: Cloud ecosystem players at the network edge

These dynamics place communications service providers (CSPs) at the intersection between enterprises and hyperscalers. They can offer hyperscalers access to their valuable “beachfront” real estate at the edge, and can leverage their longstanding relationships with enterprises to provide access on-ramps to the cloud.

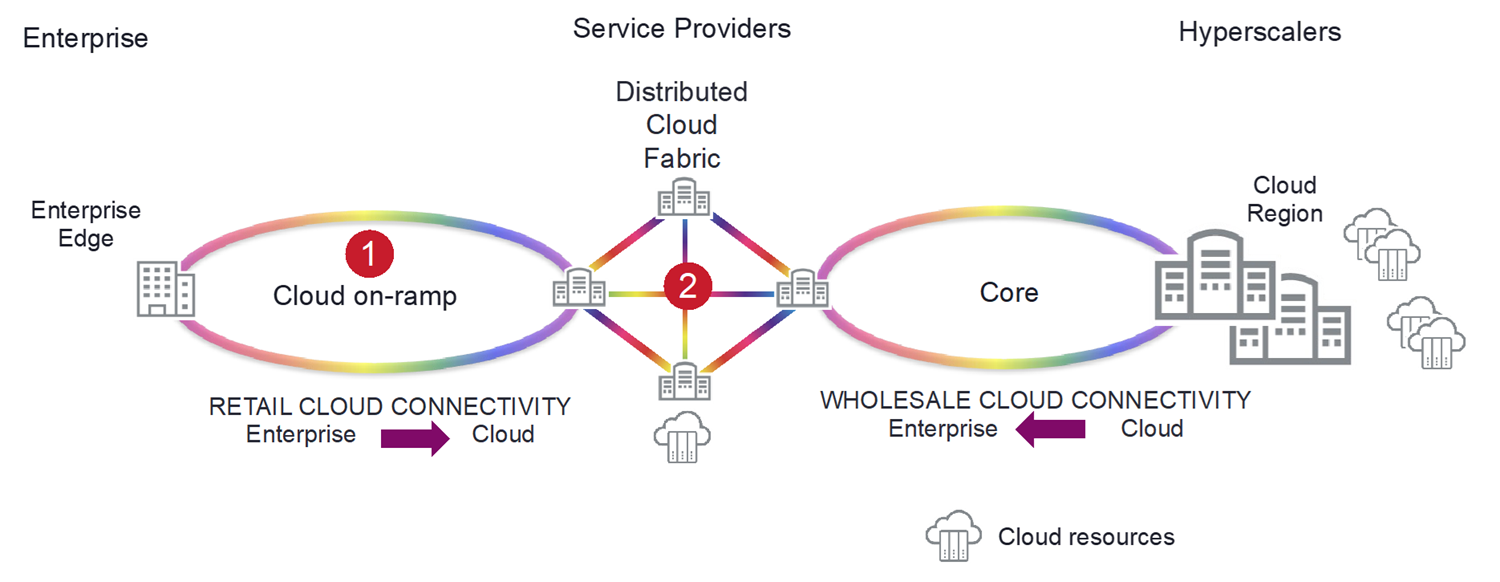

Taking advantage of this opportunity requires a network architecture that allows CSPs to deliver scalable cloud services and meet the requirements of both hyperscalers and enterprises. As shown in Figure 2 below, critical to this architecture is: 1) a scalable cloud on-ramp, and 2) a distributed cloud fabric.

Figure 2: Cloud architecture for CSPs

- Scalable cloud on-ramp: This is a new retail service cloud approach, which is needed to provide scalable cloud on-ramps with a consumption-based billing system that aligns with the way hyperscalers deliver cloud services today. This concept provides very scalable 100/400Gb/s and higher cloud on-ramps where enterprises pay by the time (hours) for data to be migrated to the cloud. This approach is needed to remove the current obstacle of lengthy migration times to the cloud which is holding enterprises back from leveraging the cloud to a greater extent.

- Distributed Cloud Fabric: This is the part of the network where retail and wholesale connectivity intersect and where service providers are uniquely positioned to connect enterprises to multiple cloud providers. There’s a need here for very large scalability (400/800Gb/s to Tb/s), any-to-any connectivity, and the ability to migrate data between cloud providers to address the need for multi-cloud capabilities.

The cloud is proving to be an exciting enabler for IT innovation. Without the sheer computing power of the cloud, enterprises wouldn’t be able to leverage services such as AI and machine learning.

The network is a key building block for cloud services, and CSPs are uniquely positioned to exploit their “beachfront” edge real estate and their existing enterprise relationships to act as a broker to multiple cloud providers. I’ll explore these two new CSP cloud architecture concepts in greater detail with additional blog posts over the next few months so stay tuned!

1 Source: Omdia, Cloud & Colocation Services Market Tracker, 1H22