Trends and Insights from Heavy Reading's 5G Network Strategies Operator Survey

Transport networks are critical to all mobile network deployments. They not only connect the radio access network (RAN) to the core and the content, but they are key to enabling broader 5G evolution, allowing mobile network operators (MNOs) to embrace innovations in RAN architecture that ultimately translate into better performance and lower costs.

Figure 1: RAN trends shape transport requirements - a flexible transport network is crucial to enable RAN evolution and innovation

Three key dimensions in which RANs are evolving are centralization, virtualization, and openness. As operators take steps to progressively centralize, virtualize, and open their RAN, new requirements are introduced to the xHaul transport network. Therefore, assessing operators' plans for the evolution of their RAN is critical to understand how and when transport networks must adapt and respond to shifting demands.

Heavy Reading's recently published 5G Network Strategies Operator Survey provides valuable insights on operators' plans and views on key topics of impact for transport networks.

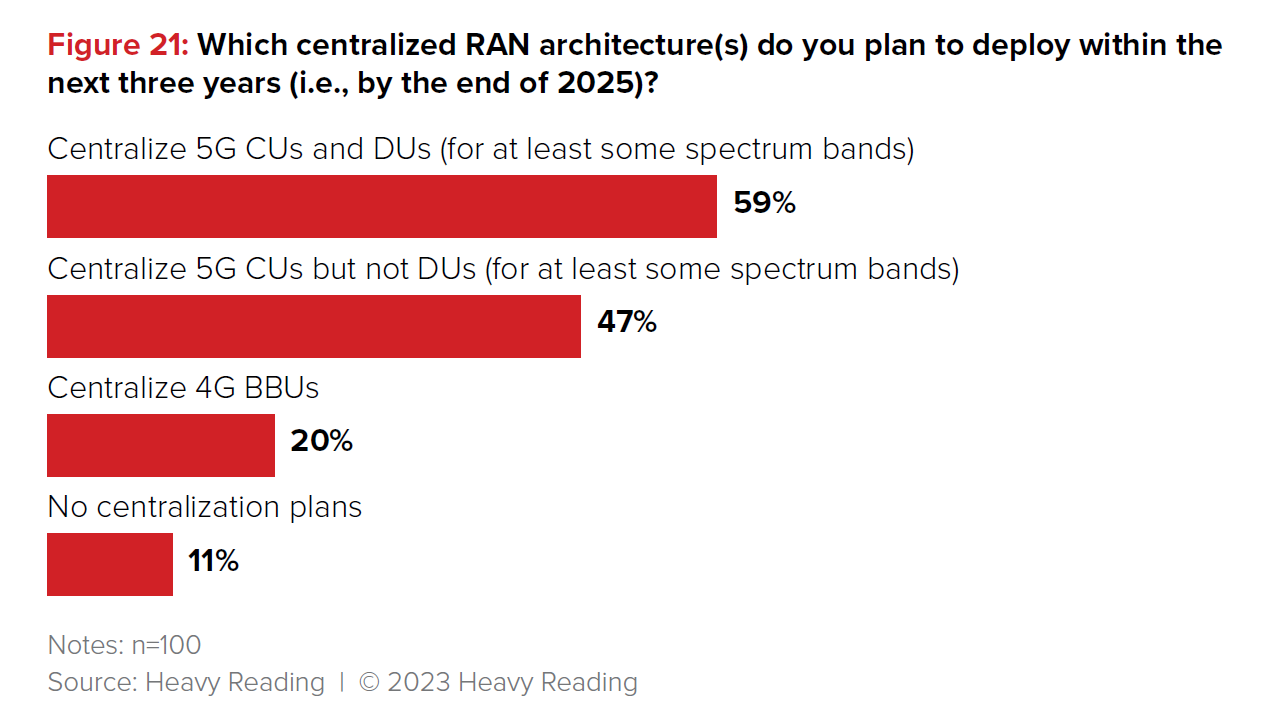

Centralization is the RAN trend that most directly impacts transport. The promise of substantial cost savings and performance improvements from splitting RAN processing and pooling resources on Centralized Units (CUs) and Distributed Units (DUs) has brought centralization to the forefront of RAN planning discussions.

However, adoption has been more limited than expected, which is commonly attributed to transport challenges prompted by the need to connect the split RAN elements, especially the bandwidth-intensive and latency-sensitive fronthaul links that connect Radio Units (RUs) to DUs.

The Heavy Reading survey recorded interesting trends in this area. Most respondents (59%) indicated their companies plan to fully centralize (CUs and DUs), at least for some spectrum bands. This is a shift from last year's survey that showed partial RAN centralization (CUs, but not DUs) as the most popular approach – an option that trailed this year's top response at 47%.

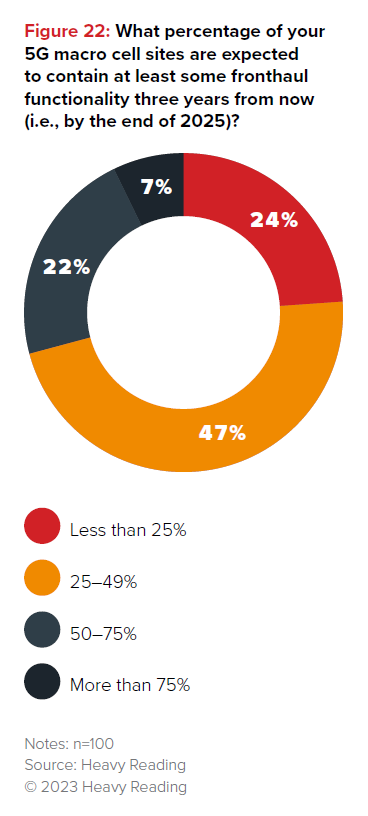

The increased willingness to face the challenges of widely deploying fronthaul connectivity as to capture the benefits of DU centralization also showed up in a question about the percentage of 5G macro cell sites expected to contain fronthaul functionality. 76% of the operators said they plan to have fronthaul in more than a quarter of their macro sites by 2025, 29% expecting it in more than half of their network.

A key challenge of fronthaul deployments is handling legacy common public radio interface (CPRI) traffic from radios. Its proprietary nature has led many operators to start tackling fronthaul through dark fiber or wavelength division multiplexing (WDM), where possible, but packetization of these traffic flows makes for a much more efficient alternative that shows growing traction.

A key challenge of fronthaul deployments is handling legacy common public radio interface (CPRI) traffic from radios. Its proprietary nature has led many operators to start tackling fronthaul through dark fiber or wavelength division multiplexing (WDM), where possible, but packetization of these traffic flows makes for a much more efficient alternative that shows growing traction.

When asked about approaches to packetized fronthaul they are considering adopting, a quarter of operators indicated their intention to move with Radio over Ethernet (RoE / IEEE 1914.3) in the next 24 months, with another 34% joining them in 2025/26. The numbers were similar for CPRI to proprietary evolved CPRI (eCPRI) interworking. As for CPRI to open RAN (ORAN) via low-PHY adaptation, it takes off just a little slower, with 24% considering it within 24 months, but grows stronger than the other options in the long term, with an additional 38% of operators looking at it for 2025/26.

The fact that each of the three main approaches to fronthaul packetization is in the plans of close to 60% of operators suggests we might be getting to an inflection point for massive centralization and fronthaul adoption.

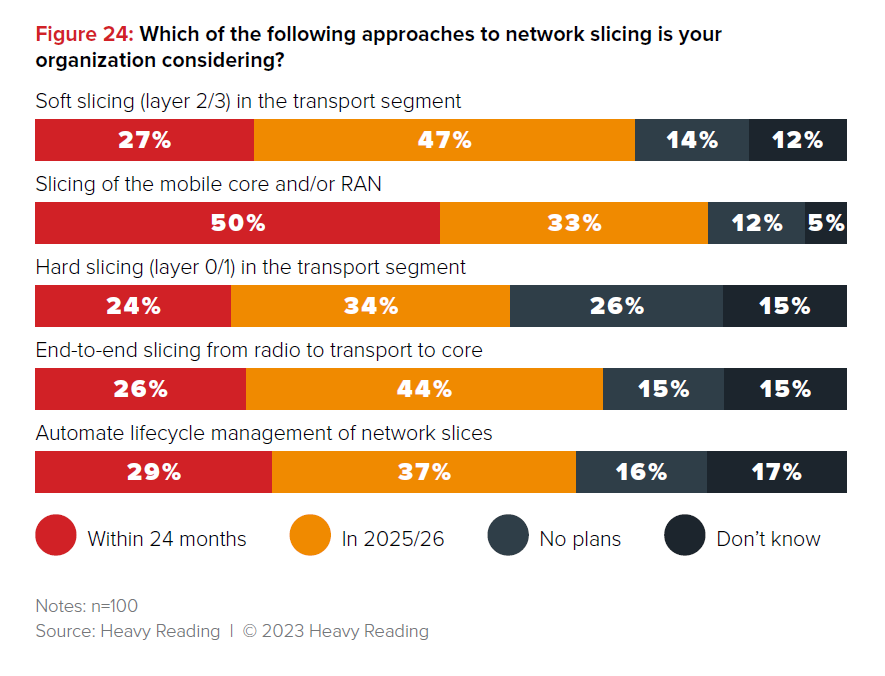

Another hot 5G topic with meaningful ramifications in transport is network slicing. The survey results show that slicing efforts are likely to start at the core and RAN, specified by 50% of the respondents as under consideration within the next two years. Transport slicing (both soft and hard) and end-to-end slicing all scored in the middle twenty percentage points of intention for 24 months. Still, when we add the longer-term intention, out to 2026, we have close to 70% of operators looking at transport slicing options. These numbers are consonant with what we have been seeing in the market: operators want to ensure their transport infrastructure is slicing-ready, even though only a few are already deploying transport slicing.

Timing and synchronization have been major challenges for operators as they evolve their 5G networks. The survey presented nine timing and synchronization requirements or concerns to be rated in importance, and every single one was assessed as critical or important by most of the respondents, with some reaching up to 81% in these two ratings. These results paint a clear picture of how central this issue has become in 5G transport and ratifies the value of comprehensive and robust support of advanced timing and synchronization techniques when selecting xHaul transport platforms to improve performance, resiliency, and network efficiency.

When talking of transport networks, bandwidth capacity is always top of mind to cope with ever-growing traffic demand. But on 5G transport, data rates are just the tip of the iceberg. Broad transport capabilities are pivotal to opening innovation paths for the RAN, as most of the emerging techniques and technologies that unlock improved user experience and network efficiency also present additional requirements to the xHaul transport.

The 5G transport network must go beyond support for 10Gb/s or 25Gb/s backhaul – it must tackle the xHaul complexity of multiple architectures blending packetized fronthaul with midhaul and backhaul. It should provide slicing-readiness, and systematically address the challenges of timing and synchronization – just to name a few facets of this puzzle highlighted in the survey.

A flexible and adaptive transport network is the foundation for a seamless 5G evolution that paves the way for continued network efficiency and innovation, and this is what Ciena strives to deliver through its 5G xHaul Network Solutions.