Get Southeast Asian data centers up and running faster with Managed Optical Fiber Networks (MOFN)

Data is on the move.

Currently, there is a surge of enterprise data – emails, sales tools, HR services, IT systems, and more – moving into the cloud, continuing to be driven by pandemic-era shifts in online data consumption.

Because of this, the cloud must scale – both in storage capacity and geographically. It must also become more distributed and move closer to the end user at the network edge. For these to be achieved, we need robust, high-capacity underlay networks, which will be key to delivering the right end user experience.

Ripe for growth

Ripe for growth

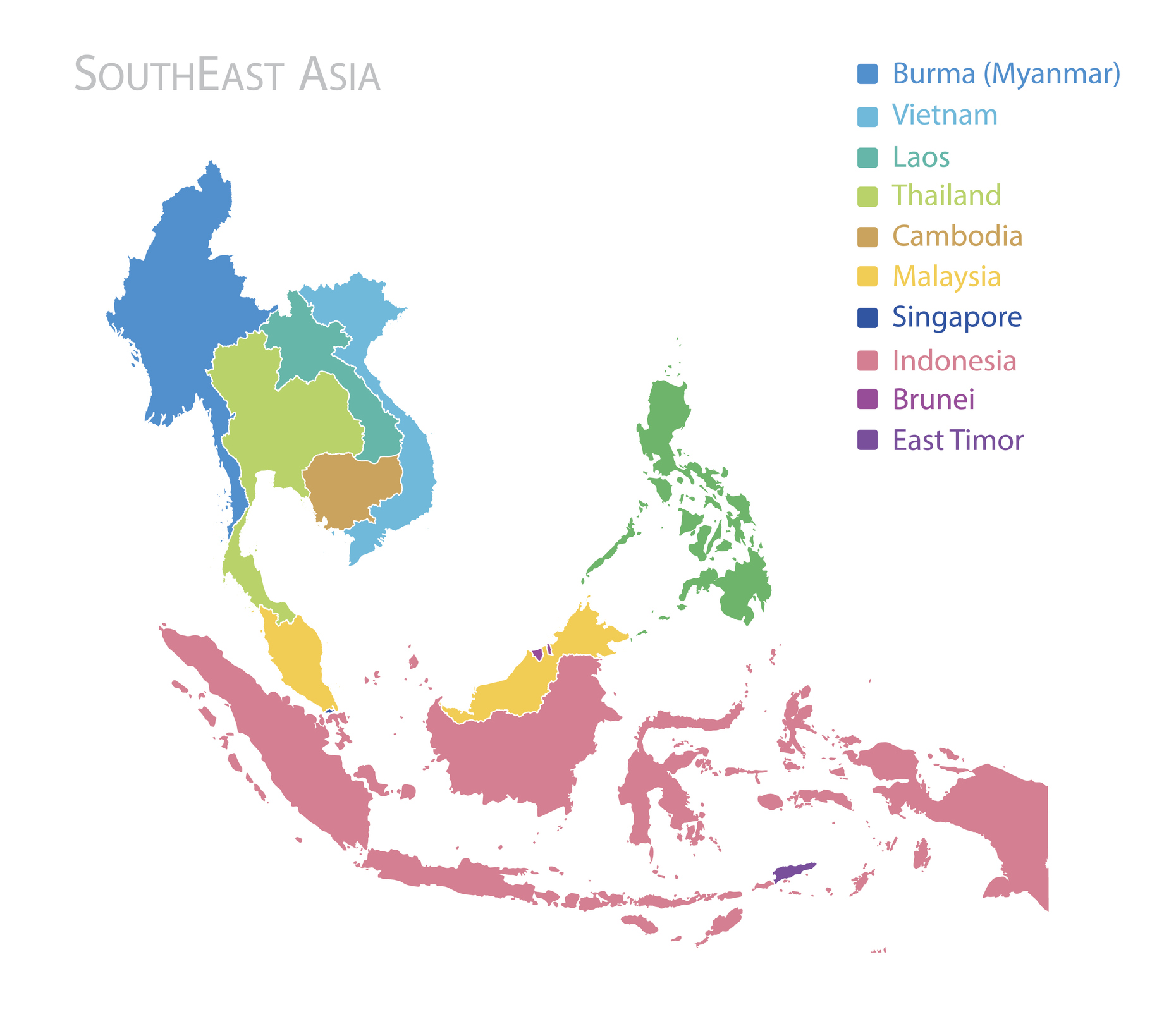

Southeast Asia is experiencing some of the world’s fastest data growth thanks to intense demand for online services that live in the cloud, both at the edge and in the core. And with lower internet penetration rates in some countries in-region, there are plenty of growth opportunities in the network space, especially as smartphone penetration is expected to grow steadily for years to come.

As such, we’re seeing brisk data center construction and expansion. Singapore, the traditional site for Southeast Asian data centers, recently ended its moratorium on new builds and opened bids for new facilities. Malaysia is also welcoming sizeable investments in new data infrastructure, totaling billions of US dollars. Thailand, meanwhile, is expected to see its own data center market grow at a CAGR of ten percent from 2022 to 2028.

With this ongoing proliferation, regional data interconnections are shifting from low-density to high-density networks to handle the increased traffic.

In this environment, all players are looking for ways to expand in the most efficient way possible.

A new win-win proposition

Enterprise connectivity services normally achieve granularity through smaller pipes connecting many locations. This approach was well-suited for a bandwidth-lease business model as telecom service providers built common connectivity infrastructure, and multiple enterprises leased smaller granularity bandwidth to serve their needs. Global content network (GCN) connectivity has very different demands – requiring very high capacity – that make the lease model difficult and sometimes prohibitive.

GCN operators could consider building, operationalizing, and managing their own dedicated connectivity infrastructure. However, this is tough in international settings. Each country has its own rules for fiber ownership, policies on licensing, and standards for workforce qualifications. These issues can be too minute for GCN operators to properly address for every country in which they have a presence.

There is an alternative model that addresses issues that arise in the preceding methods: Managed Optical Fiber Networks (MOFN). This is where telecom service providers proactively build out connectivity infrastructure while GCN operators are completing their own data center builds.

Traditionally, service providers build out new connectivity as needed after GCN operators complete data center builds and put out tenders for bidding. However, this costs GCN operators both time – up to and over a year – and money as they review pitches and negotiate costs while facilities sit idle. If both sides build out their respective portions simultaneously, the service provider can immediately step in when the GCN operator is ready to put out a tender. At this point, only a few simple touches to the prepared infrastructure are needed to achieve operability – cutting time-to-market down to just a few months.

Real-world benefits

The MOFN model creates a faster and larger revenue stream for service providers – as GCN operators are willing to pay a premium for faster fulfillment – while GCN operators get the high-capacity connectivity they need and allows them to focus on cloud revenue. Meanwhile, the end user receives a better online experience, while enterprises can outsource more functions into the cloud – the entire digital ecosystem benefits.

At Ciena, we utilize the MOFN model to provide flexibility to our service provider and GCN operator customers while also creating equal partnerships between them and ourselves. Our team considers the customers’ unique needs and examines many possible solutions to find what best serves their economic and geographical nuances so they can build scalable and robust networks that create connectivity platforms that underpin the digital revolution.