Evolution of the submarine cable network

For years, most noteworthy innovations for submarine networks were associated with Submarine Line Terminal Equipment (SLTE), which allowed submarine cable operators to upgrade their existing wet plants to total information-carrying capacities that dwarfed initial design capacities. This instantly breathed new life into existing undersea assets allowing cable operators to address bandwidth demand growth quickly and cost-effectively on an ongoing basis.

However, as we approach the Shannon Limit, which is the maximum theoretical limit of the rate at which information can be transmitted over a communications channel (submarine cable optical fiber core) of a specified bandwidth in the presence of noise, there’s increased focus on wet plant innovation with several new technologies being discussed and adopted. This will allow the submarine network industry to continue increasing the amount of information-carrying capacity along undersea data corridors.

Submarine Line Terminal Equipment (SLTE) modem evolution

The introduction of coherent modems over a decade ago was a pivotal moment for the network industry, overland and undersea. Coherent modems continue to evolve with throughput-optimized Forward Error Correction (FEC), Frequency Division Multiplexing (FDM), Probabilistic Constellation Shaping (PCS), rich instrumentation and metrics, streaming telemetry, and other technologies. These enabled submarine cable operators to transport ever-increasing amounts of data across their undersea network assets. Each modem generation increased the amount of data transmitted per channel for an aggregate higher overall submarine cable capacity, albeit using fewer modems. Increasing overall cable with fewer modems yields improved economies of scale, to combat price erosion, and better sustainability.

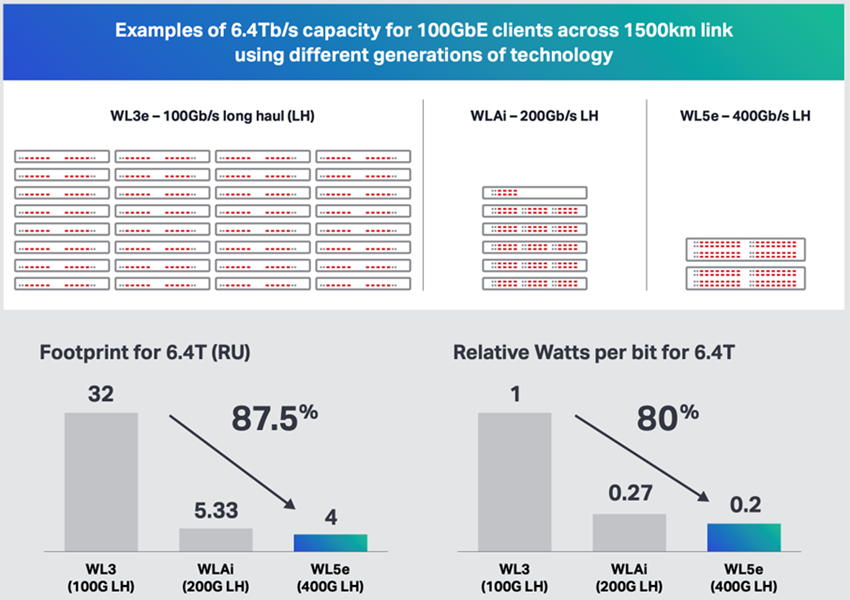

Fewer modems hosted in fewer platforms provide significant savings in associated cost, power, and space. The example in Figure 1 compares providing 6.4Tb/s of capacity over three generations of our WaveLogicTM modems yielding an 87.5% reduction in footprint and an 80% savings in energy consumption. These savings translate into tangible reductions in upfront CAPEX and ongoing OPEX, especially as it relates to soaring energy costs in many parts of the world. Although not talked about in the past as much as it is now, sustainability has always been a design goal for each generation of Ciena’s WaveLogic technology, and the result of our focus is quantifiably impressive with additional benefits upcoming with our latest generation.

Figure 1: 6.4Tb/s capacity for 100GbE clients across 1,500km link using different generations of technology

The past is impressive, but where do we go from here?

Ciena recently announced our latest generation of WaveLogic 6 optical technology, where the WaveLogic 6 Extreme variant will become the optical transmission foundation of our GeoMesh Extreme solution, which changed how submarine and terrestrial backhaul networks were designed, deployed, and operated a decade ago. Compared to WaveLogic 5 Extreme, WaveLogic 6 Extreme will provide ~ 15% of spectral efficiency improvement and 50% reduction in power and space. It will also enable 1Tb/s per channel over transpacific reaches of 12,000km and be supported in existing host platforms to further reduce waste. WaveLogic 6 Extreme will provide impressive performance gains in a highly sustainable manner. Ciena’s R&D wizards have done it again.

As we continually approach the Shannon Limit, business benefits will start to shift from massive increases in capacity on existing cables to reducing the cost, space, and energy per bit in a more environmentally and economically sustainable manner. In other words, providing the same submarine cable capacity, at the Shannon Limit, with less hardware will become the focus of SLTE modem innovation going forward. However, new wet plant innovations will allow us to side-step the Shannon Limit constraints of traditional submarine cable designs with a new generation of high-performance wet plants.

Submarine wet plant evolution

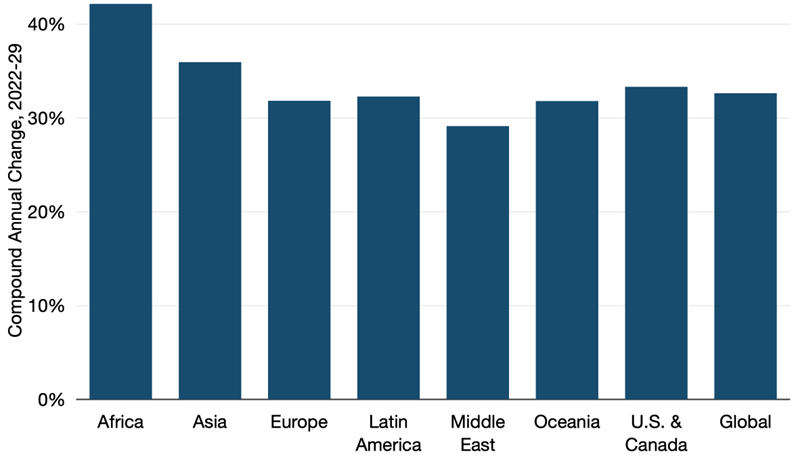

According to respected industry analysts at TeleGeography, submarine network bandwidth demand growth shows healthy growth rates for all parts of the world, as shown in Figure 2 below.

Figure 2: Used International Bandwidth Growth by Region (TeleGeography 1Q2023 forecast)

Forecasted growth varies across regions with an overall global CAGR of 33%, which means a doubling of submarine network bandwidth demand roughly every 2.3 years! This bandwidth growth simply cannot be addressed going forward without the need for ongoing SLTE modem innovation, wet plant innovation, and more cables deployed worldwide, and this is exactly what’s happening now. Several new submarine cables have been announced along different submarine network routes that incorporate new wet plant technologies with additional wet plant technologies already being looked at for the future.

Wet plants have evolved over the years, such as with the introduction of uncompensated cables. Chromatic dispersion, once the enemy of Intensity-Modulation Direct-Detection (IMDD) On-Off Keying (OOK) optical transmission, which rapidly turned light on and off to represent digital ones and zeros, became a friend of coherent optical transmission. Uncompensated wet plants are much easier to design, operate, and maintain with improved total cable capacity by allowing coherent SLTE modems to perform better. However, uncompensated cables alone cannot address Shannon Limit constraints, so more wet plant innovation is required and is already being tested in labs worldwide based on multiple public announcements.

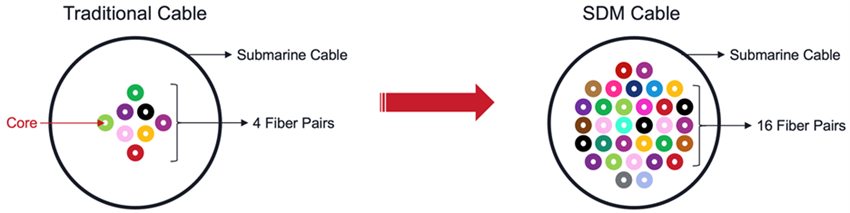

Spatial Division Multiplexing (SDM), also called “high fiber count” submarine cables, increases the number of fiber pairs from a traditional 4 to 8 pairs to 16 pairs, and in the future even higher, providing substantial increases in total capacity compared to traditional submarine cables deployed just a few years ago. You can find out more in the “Spatial division multiplexing as a new way to address ongoing growth” webinar and “With great fiber count comes great responsibility” blog. Figure 3 illustrates the SDM concept.

Figure 3: Traditional vs. Spatial Division Multiplexing (SDM) submarine cables

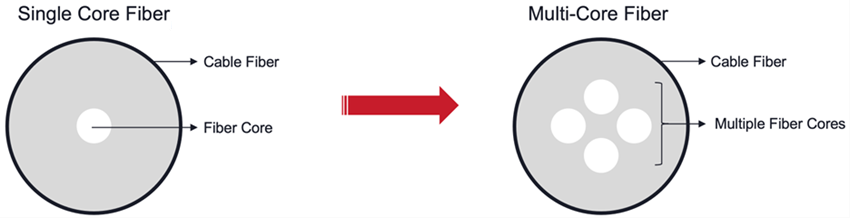

Although SDM is the new way to massively increase the information-carrying capacity of submarine cables, other wet plant innovations are being considered to further increase capacities. One such innovation is Multi-Core Fiber (MCF) cables, shown in Figure 4, which add two or more optical cores, which theoretically doubles the capacity of the fiber. If cores are far enough apart, say with 2 cores, MCF is “uncoupled”, while cores close together are “coupled”. The latter means optical transmission in adjacent cores will interact and interfere with each other thus requiring new techniques, such as Massive Input Massive Output (MIMO) used in wireless network transmission. A new generation of coherent modems that exploit coupled MCF submarine cables will subsequently require a significant amount of time, investment, and development.

Figure 4: Single-Core Fiber vs. Multi-Core Fiber (4 cores shown)

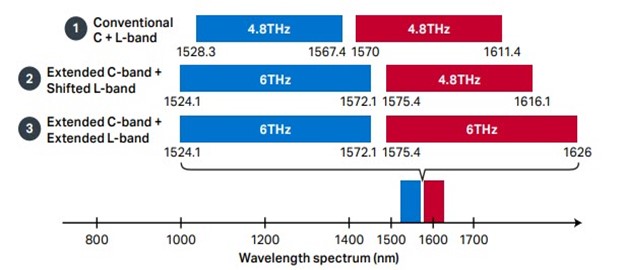

There’s also the possibility of leveraging C+L Band submarine cables, which has since been sidelined with the advent of C-band SDM cables, in the future. Leveraging L-Band, as explained by my colleague Kent Jordan in his “Battle of the bands. Get more fiber capacity using more spectrum.” blog leverages available spectrum within the fiber-optic core and requires L-band capable SLTE modems and an L-band capable wet plant.

Figure 5: Options for increasing optical fiber capacity with L-band

By leveraging the latest SLTE modems alongside SDM, MCF, and C+L Band wet plants, we should be able to achieve submarine cables with total capacities in the multiple petabits per second (Pb/s), where 1Pb/s is 1,000,000,000,000,000 bits per second – astounding!

It’ll take time to achieve these impressive capacities, as a multitude of technologies must steadily advance and coalesce, but there are other questions to be answered. If a 1 Pb/s submarine cable is accidentally cut by a rogue anchor, how and where is this much traffic rerouted? Can we provide enough electrical power to a submarine cable operating at 1Pb/s, as we’re constrained today? Do the economics of Pb/s submarine cables prove enough for submarine cable operators to justify the associated R&D investments from SLTE and wet plant vendors? These questions, and others, are already being discussed by industry stakeholders.

I have no doubt that we will eventually achieve Pb/s submarine cables. If the growth in submarine network bandwidth demand continues unabated, as an industry, we may have no choice but to commercialize Pb/s cables in the future or build many more lower-capacity submarine cables. The economic and sustainability impact will ultimately dictate the technology innovation paths of both SLTE and wet plants into the future.

Want to know more?

If you’d like to learn more about technologies discussed in this blog, check out the recent “SubOptic 2023 Show — Highlights and Key Takeaways” webinar, which is available for viewing at your offline convenience.